Whats Unique about Weinvest?

The WeInvest Digital Wealth platform is transforming wealth management across Asia & the Middle East.

Our systematic quant investment products are devoid of human emotions & biases, to provide better returns & a seamless investing experience with the best digital wealth mangement tools & solutions.

01

Great Returns

Our algorithms have generated high

returns and outperformed over market

and competitors.

03

Diverse Products

Choose from a wide range of investment products to fulfill your financial goals- multi-asset, thematic, region, and style-based, to

long and short-term investment plans.

05

Robust Investment Algorithm

Our quant investment algorithms are

completely data-driven and unbiased.

02

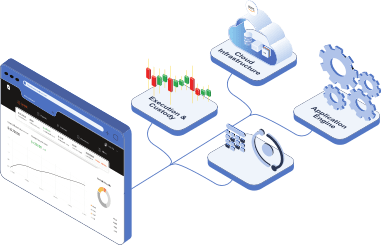

Easy-to-launch Platform

Our Multi-tenant wealth investment

platform with 400+ configurations is

easy to set up & extremely efficient

with zero upfront cost.

04

Partnership Models

Our digital investment platform offers

diverse partnership models: B2I, Whitelabel,

Introducer, SAAS API to suit your requirements.

01

Great Returns

Our algorithms have generated high

returns and outperformed over market

and competitors.

02

Easy-to-launch Platform

Our Multi-tenant wealth investment

platform with 400+ configurations is

easy to set up & extremely efficient

with zero upfront cost.

03

Diverse Products

Choose from a wide range of investment products to fulfill your financial goals- multi-asset, thematic, region, and style-based, to

long and short-term investment plans.

04

Partnership Models

Our digital investment platform offers

diverse partnership models: B2I, Whitelabel,

Introducer, SAAS API to suit your requirements.

05

Robust Investment Algorithm

Our quant investment algorithms are

completely data-driven and unbiased.

Key Highlights

WeInvest is Asia’s leading digital wealth management platform & asset management company. Headquartered in Singapore since 2015, we have a presence across Malaysia, Indonesia, GCC countries, Hong Kong, Thailand, India and china.

Clients

Collaborators